Featured

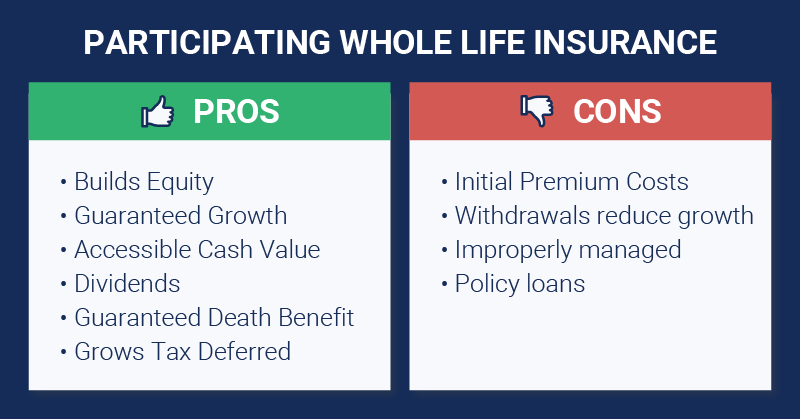

Cash worth is a living benefit that stays with the insurance provider when the insured passes away. Any exceptional lendings against the cash value will lower the policy's survivor benefit. Death benefits. The plan proprietor and the guaranteed are typically the same individual, but sometimes they may be various. As an example, an organization might acquire vital individual insurance on a vital worker such as a CEO, or an insured might market their very own policy to a third event for money in a life settlement.

Latest Posts

Best Life Insurance For Funeral Expenses

Published Apr 14, 25

10 min read

Final Coverage

Published Apr 09, 25

3 min read

Instant Universal Life Insurance Quotes

Published Apr 06, 25

7 min read