Featured

Table of Contents

That typically makes them an extra cost effective alternative forever insurance policy protection. Some term plans might not keep the costs and survivor benefit the exact same in time. Direct term life insurance meaning. You do not intend to erroneously think you're getting level term insurance coverage and after that have your death benefit modification later. Several people get life insurance protection to assist financially secure their liked ones in case of their unexpected fatality.

Or you might have the choice to transform your existing term protection right into a long-term policy that lasts the rest of your life. Numerous life insurance plans have prospective benefits and drawbacks, so it is essential to understand each prior to you determine to purchase a plan. There are a number of advantages of term life insurance policy, making it a popular choice for insurance coverage.

As long as you pay the costs, your beneficiaries will certainly receive the survivor benefit if you die while covered. That claimed, it is necessary to note that the majority of plans are contestable for two years which indicates insurance coverage could be rescinded on fatality, should a misstatement be discovered in the application. Plans that are not contestable often have actually a graded survivor benefit.

What Does Joint Term Life Insurance Provide?

Premiums are usually lower than entire life plans. With a degree term policy, you can select your protection amount and the policy length. You're not locked right into an agreement for the remainder of your life. Throughout your plan, you never have to bother with the costs or fatality benefit quantities transforming.

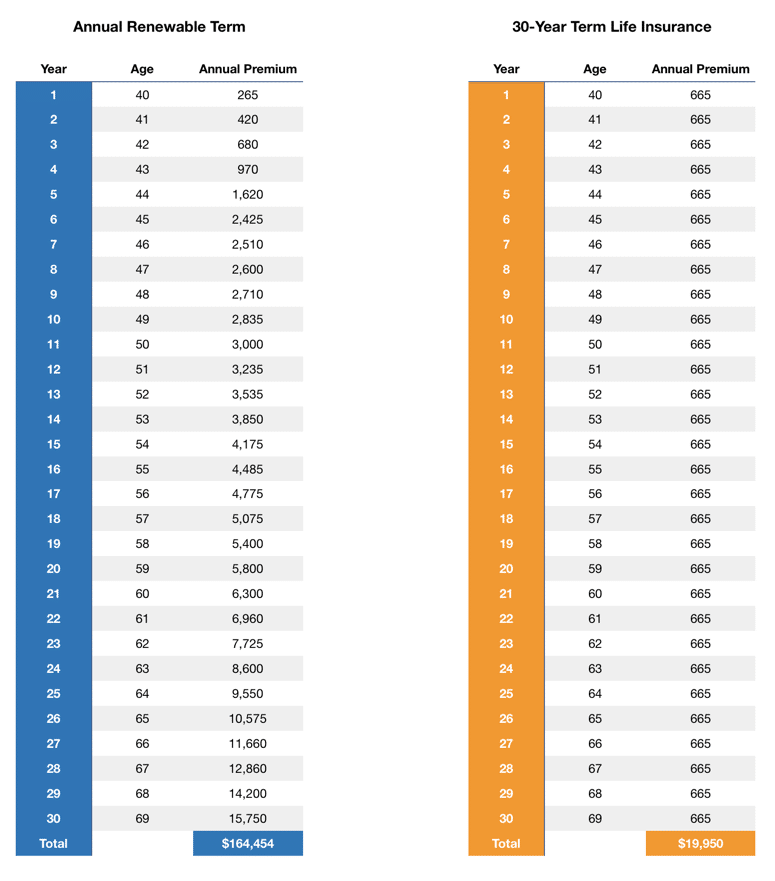

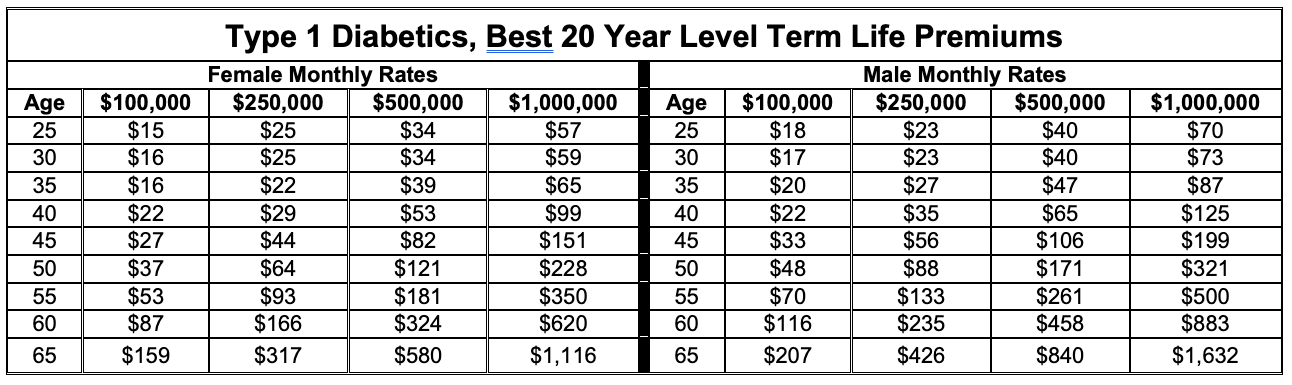

And you can't pay out your plan throughout its term, so you won't get any type of monetary take advantage of your past coverage. Similar to other sorts of life insurance, the expense of a degree term policy depends on your age, insurance coverage demands, employment, way of living and health. Normally, you'll find more affordable protection if you're more youthful, healthier and less risky to guarantee.

Given that degree term costs remain the very same for the period of coverage, you'll understand specifically how much you'll pay each time. Degree term insurance coverage also has some flexibility, allowing you to tailor your policy with additional attributes.

The Meaning of Voluntary Term Life Insurance

You might need to satisfy details conditions and qualifications for your insurer to establish this cyclist. Furthermore, there may be a waiting duration of up to 6 months prior to taking impact. There likewise might be an age or time limitation on the insurance coverage. You can include a youngster motorcyclist to your life insurance coverage policy so it additionally covers your kids.

The fatality advantage is usually smaller sized, and coverage generally lasts up until your child turns 18 or 25. This cyclist might be a much more cost-efficient method to aid ensure your kids are covered as motorcyclists can typically cover numerous dependents at as soon as. When your youngster ages out of this insurance coverage, it might be feasible to convert the rider right into a brand-new plan.

When contrasting term versus long-term life insurance policy, it is essential to bear in mind there are a few various kinds. The most usual kind of irreversible life insurance coverage is entire life insurance policy, but it has some essential distinctions compared to degree term coverage. 20-year level term life insurance. Here's a basic introduction of what to think about when contrasting term vs.

Whole life insurance policy lasts permanently, while term insurance coverage lasts for a certain period. The premiums for term life insurance policy are normally lower than entire life insurance coverage. However, with both, the costs stay the same throughout of the policy. Entire life insurance policy has a cash worth component, where a part of the costs may grow tax-deferred for future requirements.

One of the main features of degree term insurance coverage is that your costs and your survivor benefit do not transform. With lowering term life insurance policy, your costs stay the very same; nonetheless, the survivor benefit quantity gets smaller in time. You may have protection that begins with a fatality benefit of $10,000, which can cover a mortgage, and then each year, the death benefit will lower by a collection quantity or portion.

Due to this, it's typically a more budget friendly kind of level term coverage., however it might not be sufficient life insurance coverage for your needs.

What is the Function of What Is Level Term Life Insurance?

After choosing a policy, complete the application. For the underwriting procedure, you might have to supply general personal, health, lifestyle and employment info. Your insurance firm will figure out if you are insurable and the risk you may present to them, which is reflected in your premium prices. If you're accepted, sign the paperwork and pay your first premium.

Lastly, take into consideration organizing time every year to examine your plan. You may intend to upgrade your recipient info if you've had any kind of considerable life modifications, such as a marital relationship, birth or separation. Life insurance policy can sometimes feel complicated. However you don't have to go it alone. As you discover your alternatives, consider discussing your needs, desires and worries with a monetary expert.

No, level term life insurance policy does not have cash money worth. Some life insurance policy plans have a financial investment attribute that allows you to develop cash worth gradually. A part of your costs payments is established apart and can gain interest in time, which expands tax-deferred during the life of your coverage.

You have some options if you still want some life insurance policy protection. You can: If you're 65 and your coverage has actually run out, for instance, you may want to acquire a new 10-year level term life insurance coverage policy.

An Introduction to Joint Term Life Insurance

You might be able to convert your term protection right into an entire life plan that will last for the rest of your life. Numerous kinds of level term policies are convertible. That implies, at the end of your insurance coverage, you can transform some or all of your policy to whole life protection.

A degree costs term life insurance policy plan lets you stick to your budget while you assist protect your family. ___ Aon Insurance Coverage Services is the brand name for the broker agent and program administration operations of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc .

Latest Posts

Best Life Insurance For Funeral Expenses

Final Coverage

Instant Universal Life Insurance Quotes